Conversation 169: IMEXHS LIMITED [ASX:IME]

Does IMEXHS have what it takes to grab new markets by the throat?

Faster, cheaper and better is a hard combination to beat in business and I am always looking for tech companies who claim they have it.

According to the CEO of IMEXHS, a cloud-based medical imaging software solution, they are such a company.

“We can be up to 50% cheaper and still maintain margins up to 80%,” Dr German Arango said in my recent interview with him from his office in Bogota, Colombia.

When Australians think of Latin America I doubt many would think Bogata, Columbia looks like this. In fact LATAM is an increasingly popular tech spot for innovations and investment due to market size, liquidity [SoftBank set up a $5B tech fund recently], and government support.

Imaging Experts and Healthcare Services Ltd, [IMEXHS] is a Software as a Service business that was designed by doctors for doctors.

IMEXHS started in 2012 and is now entering an expansion phase that will see it enter the US and Brazil and initially target small to medium size practices in cardiology, pathology and radiology.

At the heart of the IMEXHS platform is their proprietary cloud based viewing system HIRUKO which allows health professionals to distribute or look at medical images via any device, anywhere.

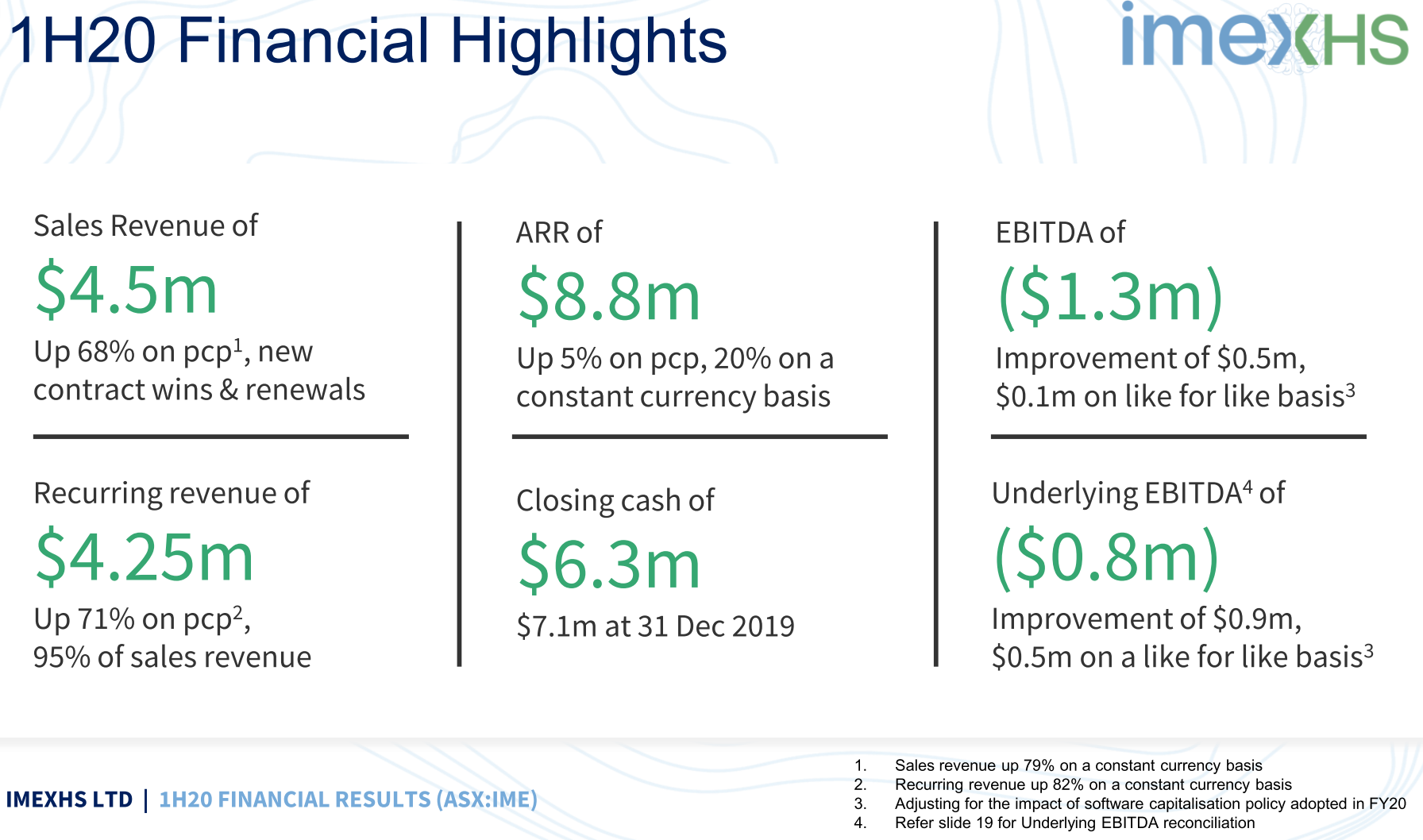

IMEXHS has more than 270 customers generating 90% of its revenue on a recurring, multi-year contracted subscription basis.

[IMPORTANT: THIS ARTICLE AND INTERVIEW IS BY NO MEANS A DEFINITIVE EXPLORATION OF THE BUSINESS FEATURED AND NO INVESTMENT DECISIONS SHOULD BE MADE BASED ON THIE INFORMATION FOUND ANYWHERE ON THIS WEBSITE. PLEASE READ OUR FULL DISCLAIMER BEFORE MAKING ANY INVESTMENT DECISIONS ABOUT ANY COMPANIES MENTIONED ON THIS WEBSITE AND SEEK THE ADVICE OF A PROFESSIONAL ADVISOR.]

Useful blog navigation links.

SHARE PRICE TREND OVER 200/100/9 DAYS l ANALYSTS VIEWS l TECH AND COMMERCIAL READINESS INDEX l ACTIVE SHARE PRICE CHART

MORE ABOUT IMEXHS:

“Imaging Software as a Service (SaaS) and ancillary service provider in Latin America. Founded in 2012, ImExHS is known for its innovation in the Latin American imaging services market, offering flexible and scalable imaging solutions via its Hiruko branded suite of solutions for next generation Picture Archiving and Communications System (PACS) and integrated Radiology Imaging System (RIS). The Hiruko system is completely cloud based, vendor neutral and zero footprint with no need for installed software. Enhanced features such as a fully web- based voice recognition option and a zero footprint DICOM viewer are some of its advanced features. In addition to PACS and RIS, imaging technology and management systems can be provided on a Platform as a Service (PaaS) basis when packaged with equipment. The ImExHS products are designed to increase productivity and save money for the users, with a scalable platform that is configured for the future, while enhancing patient outcomes.”

USEFUL LINKS

TECHNOLOGY AND COMMERCIAL READINESS.

Based on the Technology Readiness Level [TRL] developed by NASA and the Commercial Readiness Index [CRI] that grew out of it. IMEXHS would fit somewhere around 4 TO 5 on the CRI.

SOME OF THE RECENT MARKET ANNOUNCEMENTS BY IMEXHS:

IMEXHS receives Brazil’s ANVISA1 registration for HIRUKO™

IMEXHS establishes operations in the USA – the world’s largest Enterprise Imaging market

SOME RATINGS FOR IMEXHS [ASX:IME]

[CURRENT ON WEDNESDAY 2ND SEPTEMBER 2020]

Morningstar Quantitative [algorithmic] Rating *

Valuation Rating: Undervalued Fair Value Estimate: 0.056 Fair Value Percentage Diff: 28.52% LiquidityHigh

DISCLOSURE

The author does not own shares in this company at the time of writing this post. Inside Market does not accept any payment from this or any other company we cover. Inside Market charges a licensing fee for the re-publication of any content on this site. Any information in this article or anywhere on the InsideMarket site should be considered in any way, a recommendation to invest in this or any other company covered here. Nor should it be seen as a form of financial or investment advice. Disruptive technology stocks should be considered very speculative, high-risk, and extremely volatile. There are significant risks inherent in developing new technologies that are not discussed here. You should always seek professional advice before considering any share purchase or sale. Please read our full disclaimer. Insidemarket.net is intended for general news and information purposes only. Nothing in Insidemarket.net constitutes or is intended to constitute investment, financial, property, business, marketing, accounting, mortgage or legal advice and should not be relied upon by any person as a substitute for professional advice. Readers are strongly encouraged to seek independent legal, financial or other relevant or applicable advice before making any related decision. READ FULL DISCLAIMER HERE

* The Morningstar rating uses a machine-learning model to rate 22 times more funds than are rated by Morningstar analysts in EMEA and Asia.

The Quantitative Rating is an extension of the recently enhanced Morningstar Analyst RatingTM for funds (Analyst Rating), which provides an analyst's forward-looking assessment of a fund's ability to outperform its peer group or a relevant benchmark on a risk-adjusted basis over a full market cycle. Morningstar EMEA and Asia manager research analysts assign Analyst Ratings to approximately 1,260 open-end and exchange-traded funds and together with the Quantitative Rating, cover approximately 29,200 funds, representing nearly 105,000 share classes in EMEA and Asia.