Conversation 184: How Mach 7 Technologies [ASX:M7T] says it is riding a growing trend away from legacy systems in hospital data collection, storage and AI analysis.

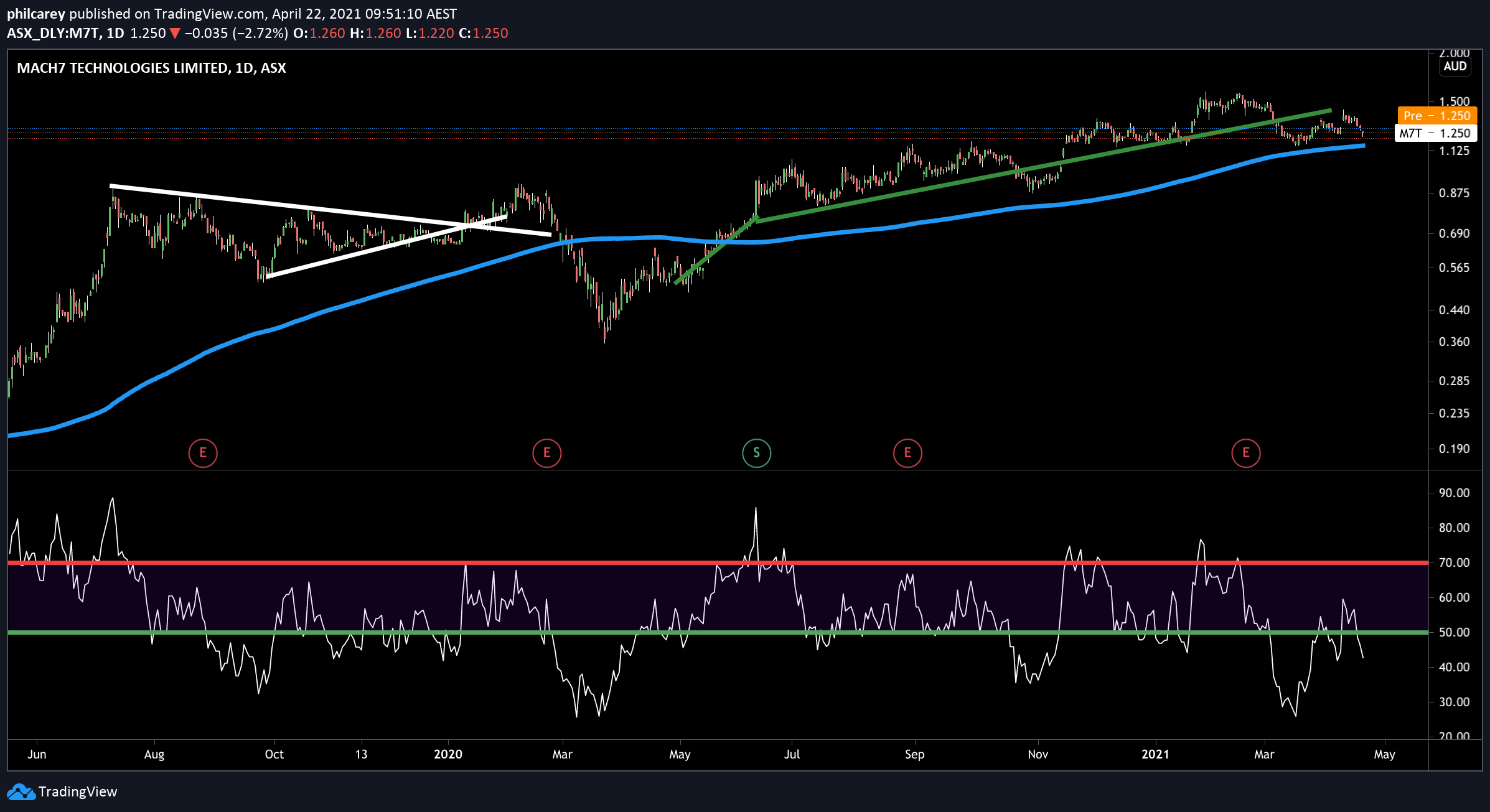

At the time of writing this Mach 7 Technologies stock price has fallen out of its trend lines and appears to be seeking a new support level.

Does this open up a buying opportunity?

I talked with CEO Mike Lampron to get a better idea of what the future holds for Mach 7.

MACH 7 TECHNOLOGIES SHARE PRICE SHOWING TREND LINE IN GREEN, 200 DAY MOVING AVERAGE IN BLUE AND RELATIVE STRENGTH INDEX IN WHITE.

About MACH 7 TECHNOLOGIES:

Mach7 Technologies Limited (M7T, formerly 3D Medical Limited) is a global provider of enterprise image management systems that allow healthcare enterprises to identify, connect, and share diagnostic image and patient care intelligence where and when needed. M7T develops data management solutions that create a clear and complete view of the patient to inform diagnosis, reduce care delivery delays and costs, and improve patient outcomes.

Third Quarter FY21 Business Update Mach 7 Technologies:

♦ Record quarterly cash receipts $8.4M (98% increase over Q2)

♦ Q3 positive cash flow from operations $3.3M (375% increase over Q2)

♦ Cash on hand has increased to $18M (from $14.4M Q2)

♦ Q3 sales orders $12.8M (Q2 $7.6M), $23.6M YTD (TCV1)

♦ Customer deployments continue to make good progress

♦ 2021 Global Enterprise Imaging Solutions Product Leadership Award by Frost and

Sullivan