Conversation 177:

The next chapter in the Archer Materials story.

Archer Materials CEO Mohammad Choucair is a smart cookie.

Not only has he played a major role in the invention of breakthrough materials like synthetic graphene but he also gets the stock market.

In the tech world, this combination of share market savvy and high level technical expertise is rare.

Despite his “on-paper” nerdiness, he comes across more like an account executive at a global ad agency (that’s a compliment!), than the CEO of a company trying to disrupt quantum computing, energy storage and biosensor industries.

In my latest Conversation #176, “Mo” as he is often referred to online, explained that “We [Archer] have 85 people working around the world so there is no shortage of news flow.”

His recognition of “news flow” gives an insight into his unique set of skills and part of the reason behind the market success Archer has enjoyed over the past few years.

He understands that investors and the general public like to know what’s going, what’s coming up and that progress is being made.

But regular news flow is the tip of the Archer iceberg and like any good berg, go deeper and you will find there is a lot more to look at.

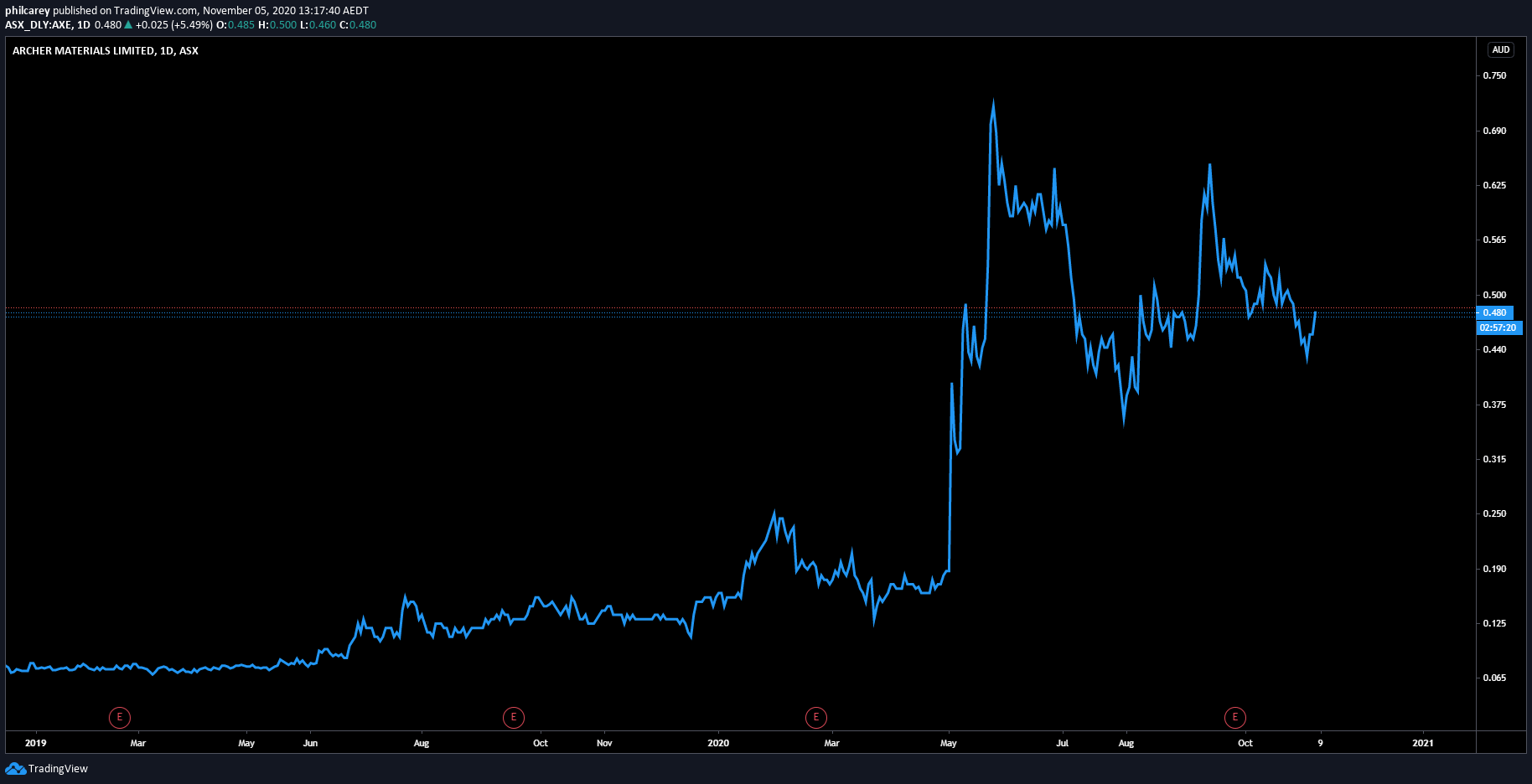

Archer Materials share price over last two years share price.

TO UNDERSTAND HOW FAR ARCHER COULD GO, SIMPLY LOOK TO ITS RECENT PAST.

Since joining Archer in 2017, Mohammad Choucair has put the company on a beefed up deep tech development path that currently has them:

Building a quantum computing chip that can operate at room temperature instead of the -272°C others require.

Patenting printable graphene biosensors

Integrating anode materials in lithium-ion batteries

Monetising the mineral exploration tenements held by Archer.

With the exception of the last point, all of this has been achieved in just three years and in scientific research terms, on the smell of an oily rag.

Formerly Archer Exploration Limited, Archer Materials began trading on the ASX under the code AXE in 2019.

Archer Exploration began as a base metals explorer in gold and iron ore.

But in 2011, it discovered significant amounts of graphite at sites in South Australia, Sugarloaf and Campoona.

Driven by Executive Chairman Greg English, the company realised these discoveries had the potential to make Archer Minerals something bigger and more sophisticated than a minerals explorer.

This realisation led to the take over a small start up, founded by Mohammad Choucair.

SINCE AQUIRING THE CHOUCAIR’S STARTUP AND APPOINTING HIM AS CEO, ARHCER’S GONE FROM 15c to 52c A SHARE.*

Choucair was the first person in the world to synthesise graphene at scale, was a Councillor on the World Economic Forum’s Council for Advanced Materials and played a significant role in development of lithium batteries and hydrogen fuel cells.

But for someone who also has more than 38 scientific research papers to his name at Sydney Uni alone, “Mo” has also shown strong entrepreneurial skills since joining Archer.

He has managed to engineer his teams way into:

One of the best chip fabrication research facilities in the southern hemisphere at Sydney University.

Has partnered with IBM to further develop Archer’s room temperature quantum computing chip called 12CQ.

Struck a collaborative deal with the University of New South Wales around carbon-based battery technology development.

Partnered with an unnamed German biotech company to develop its graphene ink based biosensors.

Shown that the graphite from its Eyre Peninsula Graphite Project can produce extremely high quality graphite for us in lithium batteries for electric cars and computing equipment.

“Global technology advantage”, “Streamlined development” and “Fast tracked” are all phrases you will see peppered among ASX announcements for Archer Materials.

ARCHER MATERIALS FINANCIAL FROM REPORT JUNE 2020

$2.2m Cash in bank as of 31 Mar 2020

-

Number of ordinary shares on issue 213.4m

-

Market capitalisation (8 Jun 2020) $133m

-

No corporate debt (as of 8 Jun 2020)

-

6-7x 1-year shareholder return (8 Jun 2020)

-

28% of issued shares held by top 20 shareholders

*share price current at time of publishing (12.11.2020)

SOME OF THE RECENT MARKET ANNOUNCEMENTS BY ARCHER

Archer’s A1 Biochip™ development commences

First Quarter Activities Report For the three months ending 30 September 2020

A SAMPLE OF RATINGS FOR ARCHER

[CURRENT ON FRIDAY 13TH 2020]

Morningstar Quantitative [algorithmic] Rating *

Valuation Rating: Undervalued - Fair Value Estimate: 0.749 - Fair Value Percentage Diff: 23.90% - Liquidity: High

* The rating uses a machine-learning model to rate 22 times more funds than are rated by Morningstar analysts in EMEA and Asia.

The Quantitative Rating is an extension of the recently enhanced Morningstar Analyst RatingTM for funds (Analyst Rating), which provides an analyst's forward-looking assessment of a fund's ability to outperform its peer group or a relevant benchmark on a risk-adjusted basis over a full market cycle. Morningstar EMEA and Asia manager research analysts assign Analyst Ratings to approximately 1,260 open-end and exchange-traded funds and together with the Quantitative Rating, cover approximately 29,200 funds, representing nearly 105,000 share classes in EMEA and Asia.